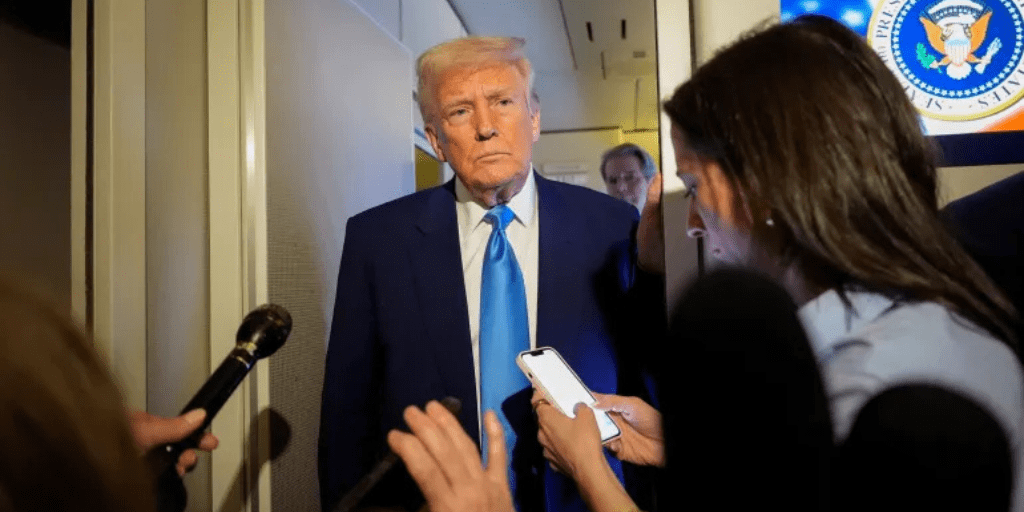

Trump’s Tariff Gamble: Markets Soar Amid 90-Day Pause, China Targeted with Historic 125% Levy

By Rakibul Hasan, Trendy Web Stories | April 10, 2025

The Announcement That Shook Global Markets

At 1:28 PM ET on April 10, 2025, President Donald Trump upended global trade dynamics with a Truth Social post that sent Wall Street into a frenzy. Declaring a 90-day pause on reciprocal tariffs for most nations, he simultaneously escalated hostilities with China by imposing an unprecedented 125% duty on imports. The move came after a week of market turmoil, business backlash, and a bond yield surge that threatened to destabilize the U.S. economy.

Market Euphoria: Nasdaq’s Biggest Gain Since 2008

Within minutes of Trump’s announcement, the Nasdaq Composite (^IXIC) skyrocketed 11.25%, marking its largest single-day jump since the 2008 financial crisis. The S&P 500 (^GSPC) surged 8.76%, while the Dow Jones Industrial Average (^DJI) climbed 7.14%, gaining over 2,700 points. Tech giants led the charge:

- Nvidia (NVDA): +15%

- Tesla (TSLA): +17%

- Apple (AAPL), Amazon (AMZN), Meta (META): ~10% gains

“This is the biggest day in financial history,” Trump boasted during a press briefing, dismissing concerns about prior market losses.

Section Break: The Tariff Timeline

From ‘Liberation Day’ to ‘Liquidation Day’

Trump’s tariff saga began on April 2, 2025, with a policy rollout he dubbed “Liberation Day.” The plan proposed astronomical duties on over 50 trading partners, including allies like Japan and India—and even Antarctica’s penguin-inhabited Peter I Island. Economists blanched at formulas derided as “sketchy math,” predicting consumer price spikes and supply chain chaos.

By April 9, the S&P 500 had plunged 12%, erasing $4 trillion in market value. Bond markets added to the panic, with 10-year Treasury yields spiking to 4.51%—a 15-year high—as investors fled to safety.

Section Break: The 90-Day Pause – Who Wins, Who Loses?

Reciprocal Tariffs Slashed to 10%: Temporary Relief for Businesses

The 90-day freeze lowers retaliatory tariffs to 10%, offering respite to companies like Ford (F) and Walmart (WMT), which faced 50-75% duties on imports from Vietnam and India. However, the reprieve excludes China, now subject to a 125% duty across electronics, machinery, and renewable energy components.

Why 90 Days?

Hedge fund titan Bill Ackman, a Trump ally, had publicly urged a negotiation window. His April 7 tweet—“90 days could prevent a depression”—reportedly reached Trump through Treasury Secretary Scott Bessent. While Bessent denied market volatility influenced the decision, analysts note the timing coincides with $9.2 trillion in maturing U.S. debt, requiring lower yields for affordable refinancing.

Section Break: China’s Retaliation and the Trade War Escalation

Beijing’s ‘Economic Bullying’ Accusation

Hours before Trump’s announcement, China’s Commerce Ministry condemned U.S. “hostility,” vowing to fight “until the end.” On April 11, Beijing will enact 84% tariffs on American soybeans, Boeing (BA) aircraft, and Texas crude oil—a direct hit to farm states and energy giants.

Historical Context

This escalation dwarfs the 2018-2020 trade war, where peak tariffs reached 25%. Experts warn a 125% levy could decimate $550 billion in annual Sino-U.S. trade, forcing companies like Apple to accelerate supply chain exits from China.

Section Break: Bond Market Tug-of-War

Why Treasury Yields Terrified the White House

The 10-year yield’s meteoric rise to 4.51% on April 9 signaled collapsing confidence in U.S. debt sustainability. With interest payments consuming 14% of federal revenue, Bessent prioritized yield suppression. The tariff pause succeeded temporarily—yields fell to 4.3% post-announcement—but long-term risks persist.

Debt Ceiling Déjà Vu

Congress must address the $31.4 trillion debt limit by June 2025. Trump’s team fears a 2011-style downgrade if yields stay elevated, potentially triggering a self-fulfilling crisis.

Section Break: Corporate America’s Rollercoaster

From Panic to Relief – CEOs React

Salesforce (CRM) CEO Marc Benioff, who warned of “catastrophic IT cost hikes,” praised the pause as “a chance to breathe.” Conversely, Tesla’s Elon Musk faces a dilemma: absorb China tariffs or hike Model Y prices by $15,000.

Small Business Lifeline?

Main Street businesses, like Brooklyn-based importer TradeCraft, had braced for 60% tariffs on Vietnamese textiles. Owner Lila Nguyen told Inc., “This pause saves my company—but 90 days flies fast.”

Section Break: What’s Next? 3 Scenarios for the 90-Day Window

- Deal-Making Miracle (20% Probability): Trump secures bilateral agreements with India, Japan, and the EU, replacing tariffs with quotas.

- Collapse and Escalation (55% Probability): Talks fail, triggering 50%+ tariffs in July and a 10% S&P correction.

- China Wildcard (25% Probability): Beijing devalues the yuan 20%, igniting a currency war.

Section Break: Investor Takeaways

- Tech Stocks: Buy semiconductor firms (AMD, INTC) diversifying from China.

- Bonds: Short-term Treasuries remain risky; consider gold as a hedge.

- Commodities: Soybean futures will plummet; crude oil faces volatility.

Conclusion: A Fragile Calm

Trump’s tariff pause offers temporary market euphoria, but the 125% China duty cements a divided global economy. As Melissa Angell reported, businesses must use this window to pivot supply chains, while investors brace for a summer of reckoning.

Follow Us Trendy web stories for real-time updates.

Leave a Reply